Me and My Team

I am a Certified Financial Planner™ professional with a law degree and have been providing fee-only investment management and financial planning services for more than 20 years. Over the years, I’ve been named a NJ Five Star Wealth Manager (Five Star Professional), Best Financial Advisor for Doctors (Medical Economics), and Best Financial Advisor for Dentists (Dental Practice). To stay on top of current industry trends and learn from other industry professionals, I belong to a number of financial planning and legal professional associations, currently including the XY Planning Network (founding member), American Bar Association, and the Greater Middlesex/Somerset Estate Planning Council (board member since 2009). Importantly, I am also a member of National Association of Personal Financial Advisors (NAPFA), the country’s leading professional association of Fee-Only financial advisors.

My commitment to you means more than any certificate on a wall. I give my clients award-winning financial service through a personal, hands-on approach. I founded The Investment Connection in order to provide customized financial planning and investment management services to individuals and families regardless of their net worth, income, or investable assets. Many firms say they offer customized services. What they actually provide are one-size fits all model portfolios or financial plans from pre-packaged software. My services are truly customized to my clients’ needs. Whoever you are, I want to help you find the right financial path to meet your goals.

I am also Of Counsel at Brooker Law Offices LLC, where my practice is limited to estate planning. Please visit www.brooknerlaw.com for more information.

Please view my LinkedIn profile for more information.

I am regularly interviewed by NJMoneyHelp on financial planning topics.

My Team

Bill joined The Investment Connection as an Investment Advisor Representative in 2015. He is a New Jersey licensed Certified Public Accountant with years of experience providing tax services to young adults, families, retirees, and small business owners. Bill especially enjoys working with entrepreneurs. Please visit www.williamsomers.com for more information on Bill’s background and his CPA firm, William Somers, CPA, LLC. When not working, Bill spends time with his family and enjoys many outdoor activities including motorcycling, hiking, biking, running, skiing, hunting, fishing, and camping, as well as learning to play both the guitar and the banjo.

Please view Bill’s LinkedIn profile for more information.

How Do You Know When You Have Found the Right Wealth Manager?

Finding qualified, independent financial advice should not be difficult—but with so many people claiming to be financial planners, financial advisors, financial counselors, or wealth managers, how do you know when you’ve found someone who can really help you? The Investment Connection is founded on core virtues that underlie every client relationship.

Integrity: Your advisor can be trusted to act in your best interests at all times.

Experience: Offering the knowledge and practical wisdom gained from prior client situations.

Professional Certification: We have the training and education to perform our role at the highest level.

Empathy: Someone who cares about YOU. Who knows you – your fears, your hopes, and what matters most to you. A true partner in getting you where you most want to go.

You

You have financial questions And you want great answers. You may have financial stress and you would like relief. You have financial hopes and would like them realized. And beyond that, you also have a deeper wish for a thriving, peaceful financial life.

When it comes to your wealth, there are really three things you want:

- Financial Freedom – enough money to support you for the rest of your life.

- Financial Security – confidence that your wealth is secure.

- Financial Peace – clarity, ease, and comfort in your financial life.

Sure, portfolio management is important. And, you are looking for something more: a partner who is down-to-earth, financially savvy, and great with you. You want your money exquisitely cared for, and you want the focus on what you care most about – creating and sustaining wealth to support a life you love.

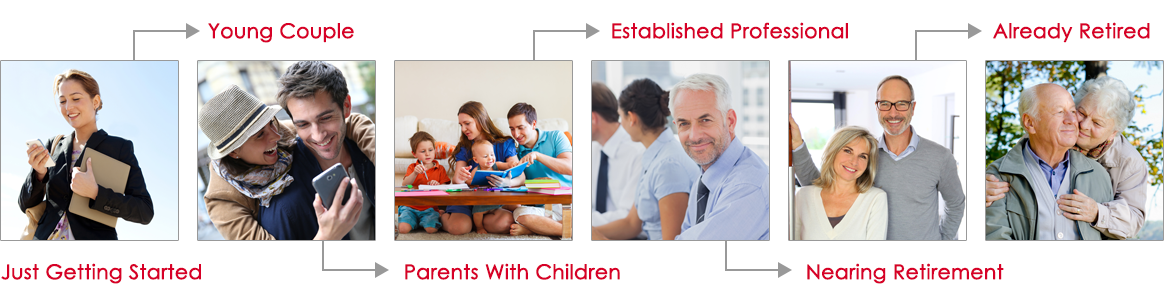

Just Getting Started

- How should you create your first budget?

- What is the best way to manage student debt?

- Build up savings or pay down debt?

- Do you understand your credit score?

- Buy or lease a car?

Just Married

- What money moves to make when we get married?

- Considering buying your first home?

- Setting up the college fund for your new baby?

- Is it time to consider life insurance?

- How should you set up your beneficiary designations?

Parents with children

- Does it feel like you are spending too much?

- How to pay for kids college education?

- Is it smart to pick up some additional life insurance?

- Do you need a will or a trust?

- Are you on track for retirement?

Established Professionals

- Are my investments positioned properly?

- Getting killed in taxes?

- What to do with your company stock and options?

- What to do with old 401(k)’s?

- How can I get my company to work harder for me?

Nearing Retirement

- Will you be able to retire on time?

- What is the smartest age to begin taking social security?

- Should I get long term care insurance?

- How should I talk to my parents about their estate?

- Going through a divorce? A 2nd divorce?

Already Retired

- How can I get more income out of my assets?

- What is the best way to manage my overall estate plan?

- Are there smart money moves for my children/grandchildren?

- How do I sell the family business to my children?

- When do I need to start taking required minimum distributions?

Us

We’ll spend some time together so I get to know you and learn how I can best help you achieve your financial goals. I strive to have a close relationship with each and every one of my clients. I want you to feel comfortable that your money is invested appropriately and that you have a plan for the future. Consider me your counselor for all of your financial needs.

- Starting Junior’s college fund? Let’s talk.

- Worried about the dip in the market that’s all over the news? Let’s talk.

- Interested in investing in a socially responsible manner? Let’s talk.

- Wondering if you have enough income to maintain your lifestyle in retirement? Let’s talk.

And remember that it’ll always be with me. Not a junior associate, not an unfamiliar customer service representative every time you call, and certainly not just a computer help screen. I’m here to give you personalized advice tailored to fit your situation, and I’m here whenever you need me. I won’t give you a cookie-cutter solution – I’ll give you what’s best for you and your money.

Let’s get to know each other through a free consultation.