A recent report from the National Academies of Science, Engineering and Medicine concluded that there’s more to caring for the older adult population than services and support for aging individuals. An equally urgent need is resources for the family caregiver who is so integral to their care. The report found that nearly 18 million Americans care for a relative older than 65. And that those providing support are often thrust into the family caregiving role without the preparation, services, support and information they need. Click below for a list of 12 useful online caregiving resources provided by FirstLight HomeCare.

Read moreYear: 2016

My friend Kal Barson, CPA, recently wrote a nice summary of the recent tax changes in NJ. To read his summary, please click below.

Read moreOctober 15th marked the start of the Medicare Open Enrollment period which lasts until December 7th. During this time, people 65 and older can switch to a different prescription drug plan (Part D) or Medicare Advantage program (Part C) or switch from Medicare Advantage to Original Medicare (Parts A/B). Oh joy.

Read moreThe Social Security Administration announced its 2017 cost-of-living adjustment will be just 0.3%. Better than nothing, but far below the historical average increase. A handful of retirees will also have to contend with increased costs for Medicare Part B.

Read moreEngaged couples aren't likely to find "update the estate plan" on many prewedding checklists, but it's an important to-do — especially if the upcoming marriage isn't your first, or if you have kids from a prior relationship.

Read moreThe cost of college is outrageous and students are borrowing more than ever. Many recent graduates struggle to pay their debt and have to forgo retirement savings early in their careers. Here's an article from the Wall Street Journal on some common student-loan mistakes to avoid.

Read moreThe biggest estate planning error is failing to have a plan. Studies have shown this is a common lapse. Read on for a list of 5 other common estate planning mistakes. Also, the following quote from the article really rings true! "Plenty of websites can set you up with a will, but these 'do-it-yourself' tools have myriad limitations. And, of course, you might never know if something's wrong with planning by this means — but your heirs eventually may."

Read moreMany students and parents need to borrow to fund the ridiculously high costs of a current college education. I always recommend maximizing use of the federal guaranteed student loan program (Stafford Loans). However, the most that is available for an undergrad is $27,000. This is spread over a 4 year period and everyone doesn't even qualify to borrow this much, so additional loans are often required. One option is to look at the NJ Student Loan program. Is the program so bad?

Read morePeople become more vulnerable to financial abuse as they age. Cognitive decline, financial errors, isolation, scams, shame, where to get help, etc. There are many issues that may apply to you or someone you know. Watch this informative clip from the Pennsylvania Department of Aging.

Read moreAlthough recent media coverage might lead you to believe that "smart beta" investing is a new-fangled trend, the truth is it has existed for decades. I am a fan of the concept and have been incorporating it into my client's accounts for years. Here is an excellent article on smart beta investing written by Dave Gedeon, Head of Research & Development at Nasdaq Global Indexes.

Read moreOverwhelmed with student debt? Confused about the multitude of repayment options? Give me a call - I can help point you in the right direction. Plus, I can help with all of your other financial planning and investment needs. As a lawyer and a financial planner, I am happy to share the following article that Heather Jarvis, a former lawyer turned student loan expert, wrote for the XYPN Blog.

Read moreHaving a Will is just as important for ordinary folks as it is for multi-millionaires – and failing to organize your estate is a major financial mistake for anyone. Watch this short video by CNBC’s Sharon Epperson to learn simple steps you can take to set up your Will and other essential documents that comprise your estate plan. Contact a qualified estate attorney for assistance drafting the documents.

Read moreMaintaining a healthy balance in your operating checking account is the first step towards financial security. A good credit score is an important next step because it can improve your purchasing power. Read on to find out more about your credit score and credit history.

Read moreIt amazes me how people with collections of fine art, antiques, jewelry, or other items do not have insurance. They often don't have any documentation on the collection at all! The following article offers some suggestions on how to get started safeguarding these valuables.

Read moreThe media is always quick to point out the vulnerabilities of sending secure information via email because cyber criminals are waiting to snatch it. While I believe it is important to consider safety with online activities, I also find it very odd that people don't worry about their regular mail. Allowing mail to sit in an unlocked box outside the house for hours each day knowing it could contain highly sensitive personal financial or healthcare information seems equally risky. Argh - safety is just not convenient

Read moreMarket sentiment is very fickle and can turn quickly. Just look at the first quarter of 2016 as an example. It was a tumultuous period for stocks. The new year began ominously, as a global economic slowdown and the December decision by the FOMC to raise rates conspired to produce stocks’ worst two-week opening on record. The S&P 500 tumbled about 9% early in the year and remained depressed through the middle of February. Just as quickly, their gloom lifted and the S&P 500 Index rebounded to actually finished the quarter with a +1.4% gain? Has the negative tide turned for good or are there still risks that could derail the market's move higher?

Read moreThe Financial Planning Association of New Jersey (FPANJ) reports that they continue to hear of people who receive phone calls or voicemails from "the IRS" demanding payment or requesting a debit/credit card number or even threatening to bring in local police. The scammers tend to target older individuals. The FPANJ wants to remind you that the IRS will never contact you by phone and will never demand immediate payment. The IRS issued a consumer alert in 2014 pointing out five easy ways to spot a suspicious call that still applies today. Click "Read More" for the link to the alert.

Read moreYou should be gearing up now to prepare your federal and state income tax returns for last year. Whether you are tackling the task yourself or hiring a professional to help, you may be wondering how long do you really need to keep tax records and supporting documentation. See the following link for suggestions from William Somers CPA.

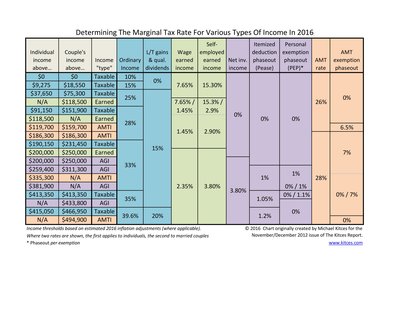

Read moreThis super handy tax chart details some of the various factors that can impact a taxpayer’s marginal tax rate, including both ordinary income tax brackets and the Alternative Minimum Tax (AMT), the tax treatment of long-term capital gains and qualified dividends, the payroll taxes that apply to earned income for wage employees and the self-employed, the new 0.9% (on earned income) and 3.8% (on net investment income) Medicare surtaxes, and the impact of various phaseouts

Read moreIf you have kids applying for college or already in college, you should be familiar with the Free Application for Federal Student Aid (FAFSA) form. The FAFSA must be submitted every year you want to apply for federal and state financial aid. Many colleges and universities, especially public institutions, also require the FAFSA. Even students who may not be eligible for need-based aid will likely be eligible for some form of financial aid, such as the unsubsidized federal student loan, known as a Stafford Loan, so filling out this form is really a necessity. The US Department of Education put together a nice piece highlighting 11 common FAFSA mistakes.

Read morePeople are only now started to talk about it, but we have been under attack for months! Some other energy-rich countries (led by our friend, Saudi Arabia) are trying to destroy US energy independence by flooding the market will oil. The strategy against us is working!

Read more