You should be gearing up now to prepare your federal and state income tax returns for last year. Whether you are tackling the task yourself or hiring a professional to help, you may be wondering how long do you really need to keep tax records and supporting documentation. See the following link for suggestions from William Somers CPA.

Read moreMonth: February 2016

15 Feb 2016

1 Feb 2016

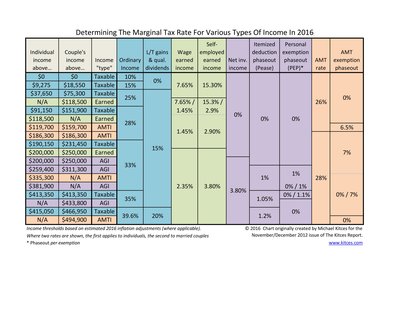

This super handy tax chart details some of the various factors that can impact a taxpayer’s marginal tax rate, including both ordinary income tax brackets and the Alternative Minimum Tax (AMT), the tax treatment of long-term capital gains and qualified dividends, the payroll taxes that apply to earned income for wage employees and the self-employed, the new 0.9% (on earned income) and 3.8% (on net investment income) Medicare surtaxes, and the impact of various phaseouts

Read more