The typical inheritance isn’t huge, but research going around the industry now indicates that a lot of little bequests are being squandered fast. Even when big bequests above $100,000 are at stake, all the money disappears 18% of the time. The heirs spend it all and end up without a lot to show for it. Reports show lump-sum distributions for retirees are similarly bad. For about 7 million Americans, the fruits of decades of painstaking money management will evaporate fast. Don't let your financial resources go down the drain. Engage an experienced fee-only financial planner and investment advisor to help you make sound decisions with your money. Continue reading for more sobering statistics.

Read moreArticles

Happiness comes in so many different forms that it can be hard to define. Unhappiness, on the other hand, is easy to identify; you know it when you see it, and you definitely know when it’s taken ahold of you. Benjamin Franklin said “The Constitution only gives people the right to pursue happiness. You have to catch it yourself.”

Read moreGot a new bundle of joy in your household? Here is a really nice slideshow from Kiplinger showing 10 opportunities to cut your tax bill as you grow your family.

Read moreIf you aren’t careful about the timing of your Medicare enrollment, you could make a very costly mistake — one that will cost you for the rest of your life. The first decision date for Medicare is at age 65 — even if you are still working, covered by your employer's health plan (or your spouse's employer's health plan), and not receiving Social Security benefits yet. This is especially important if your health plan is sponsored by a small employer (less than 20 employees). Read on for the details.

Read moreQuestion - My son got in Early Decision to a very expensive college and he accepted. I only have saved $80,000 and the school will cost $60k+ each year. What are the options to fund this? He didn't get scholarships and I want him to avoid loans. Help! Keep reading to see my Answer.

Read moreHigh school students are about to graduate. In some respects its been a long 18 years getting to this point. In other respects, the time has surely flown by quickly. Hopefully, not so quickly that you haven't prepared for the next chapter in your child's education - college! Yikes, according to the CollegeBoard's most recent data, the average college costs more than $36,000 per year (tuition, room & board, and other expenses). In-state college costs are typically lower, but many private schools cost $60,000 or more! Scholarships, grants, and financial aid are all great ways to lower costs, but not every student will qualify... so it is imperative for parents to start saving early and a 529 plan is a great place to start. Check out the link below for some common myths about 529s.

Read moreLong-term stock returns come from four components: inflation, growth of real earnings per share (EPS), the dividend, and the change in valuation. Using this formula indicates equities are overvalued. We need to create 40% growth in earnings above and beyond price gains, stocks need to decline by 40% over a relatively short time period, some combination of the two, or investors simply need to accept that fact that they will be faced with permanently reduced returns. Can we legislate and create policy, either through government or central banks, that will enable corporate profits can expand faster than the economy to eliminate the overvaluation. History says "no".

Read moreAll hail the Internet. You can get everything you need from your computer, tablet, or smartphone. Buy stuff. Watch videos. Play games. Interact with friends and strangers. Get financial planning and investment advice. Who needs real people? Wait a minute... that can't be right.

Read moreI'm not in the habit of touting particular fund companies, but AQR is unique. This firm offers some terrific alternative investment solutions based on a quantitative investment process designed with PhD brainpower. Additionally, AQR was among the first hedge-fund managers to voluntarily register with the SEC and offer alternative strategies in a mutual fund format. This is important because it means AQR's strategies are available at reasonable cost and with daily liquidity, transparency, and regulatory oversight. AQR was featured in Barron's last year - some information is a bit dated, but it still provides insight into what makes AQR so good.

Read moreIt is that time of year to consider making an IRA Contribution. Start building your nest egg. You know you should do it! Read on for the details...

Read moreAARP suggests you consider the following steps to break through the bureaucratic maze to keep your healthcare costs lower: at the doctor's office, at the pharmacy, at the hospital, and dealing with Medicare/insurance. I'm not sure if all of these tips will actually be worthwhile, but it certainly can't hurt to investigate!

Read moreSocially Responsible Investing (SRI) focuses on companies that promote a variety of environmental stewardship, consumer protection, human rights, and diversity issues. Some feel strongly about SRI, others are only mildly interested, and it’s a non-issue for many investors. Regardless of your politics, I thought you would be interested in some early thoughts on SRI issues in the upcoming Trump era.

Read moreI am honored to be a 3- time winner of the Five Star Wealth Manager Award and be listed in New Jersey Monthly magazine.

Read moreResearch quoted in the Harvard Business Review suggests bosses matter far more for employee job satisfaction than any other factor. What makes someone a great boss? Studies of leaders often focus on their style or charisma, but workers are also affected by their boss’s technical competence. Bad bosses can't do the employee’s job, were outsiders, and the supervisor’s level of expertise wasn't respected in the office. Read more for the full story.

Read moreIf you are considering downsizing this year, you need to be prepared to let go of some items. If you have antiques or other collectibles, deciding what to keep, give to family/friends, or donate can be troublesome, especially if you don't know what they are worth. Calling in a professional may help.

Read moreRetirement accounts and estate plans may soon be taking a major hit from theIRS, if Congress decides early next year to change the rules on a tax strategy involving inherited IRAs that many affluent families have used to their advantage for years. So-called "stretch IRAs" have been an important strategy for individuals inheriting large retirement accounts to keep taxes to a minimum, so losing this ability is a big deal!

Read moreA recent report from the National Academies of Science, Engineering and Medicine concluded that there’s more to caring for the older adult population than services and support for aging individuals. An equally urgent need is resources for the family caregiver who is so integral to their care. The report found that nearly 18 million Americans care for a relative older than 65. And that those providing support are often thrust into the family caregiving role without the preparation, services, support and information they need. Click below for a list of 12 useful online caregiving resources provided by FirstLight HomeCare.

Read moreMy friend Kal Barson, CPA, recently wrote a nice summary of the recent tax changes in NJ. To read his summary, please click below.

Read moreOctober 15th marked the start of the Medicare Open Enrollment period which lasts until December 7th. During this time, people 65 and older can switch to a different prescription drug plan (Part D) or Medicare Advantage program (Part C) or switch from Medicare Advantage to Original Medicare (Parts A/B). Oh joy.

Read moreThe Social Security Administration announced its 2017 cost-of-living adjustment will be just 0.3%. Better than nothing, but far below the historical average increase. A handful of retirees will also have to contend with increased costs for Medicare Part B.

Read moreEngaged couples aren't likely to find "update the estate plan" on many prewedding checklists, but it's an important to-do — especially if the upcoming marriage isn't your first, or if you have kids from a prior relationship.

Read moreThe cost of college is outrageous and students are borrowing more than ever. Many recent graduates struggle to pay their debt and have to forgo retirement savings early in their careers. Here's an article from the Wall Street Journal on some common student-loan mistakes to avoid.

Read moreThe biggest estate planning error is failing to have a plan. Studies have shown this is a common lapse. Read on for a list of 5 other common estate planning mistakes. Also, the following quote from the article really rings true! "Plenty of websites can set you up with a will, but these 'do-it-yourself' tools have myriad limitations. And, of course, you might never know if something's wrong with planning by this means — but your heirs eventually may."

Read moreMany students and parents need to borrow to fund the ridiculously high costs of a current college education. I always recommend maximizing use of the federal guaranteed student loan program (Stafford Loans). However, the most that is available for an undergrad is $27,000. This is spread over a 4 year period and everyone doesn't even qualify to borrow this much, so additional loans are often required. One option is to look at the NJ Student Loan program. Is the program so bad?

Read morePeople become more vulnerable to financial abuse as they age. Cognitive decline, financial errors, isolation, scams, shame, where to get help, etc. There are many issues that may apply to you or someone you know. Watch this informative clip from the Pennsylvania Department of Aging.

Read moreAlthough recent media coverage might lead you to believe that "smart beta" investing is a new-fangled trend, the truth is it has existed for decades. I am a fan of the concept and have been incorporating it into my client's accounts for years. Here is an excellent article on smart beta investing written by Dave Gedeon, Head of Research & Development at Nasdaq Global Indexes.

Read moreOverwhelmed with student debt? Confused about the multitude of repayment options? Give me a call - I can help point you in the right direction. Plus, I can help with all of your other financial planning and investment needs. As a lawyer and a financial planner, I am happy to share the following article that Heather Jarvis, a former lawyer turned student loan expert, wrote for the XYPN Blog.

Read moreHaving a Will is just as important for ordinary folks as it is for multi-millionaires – and failing to organize your estate is a major financial mistake for anyone. Watch this short video by CNBC’s Sharon Epperson to learn simple steps you can take to set up your Will and other essential documents that comprise your estate plan. Contact a qualified estate attorney for assistance drafting the documents.

Read moreMaintaining a healthy balance in your operating checking account is the first step towards financial security. A good credit score is an important next step because it can improve your purchasing power. Read on to find out more about your credit score and credit history.

Read moreIt amazes me how people with collections of fine art, antiques, jewelry, or other items do not have insurance. They often don't have any documentation on the collection at all! The following article offers some suggestions on how to get started safeguarding these valuables.

Read moreThe media is always quick to point out the vulnerabilities of sending secure information via email because cyber criminals are waiting to snatch it. While I believe it is important to consider safety with online activities, I also find it very odd that people don't worry about their regular mail. Allowing mail to sit in an unlocked box outside the house for hours each day knowing it could contain highly sensitive personal financial or healthcare information seems equally risky. Argh - safety is just not convenient

Read moreMarket sentiment is very fickle and can turn quickly. Just look at the first quarter of 2016 as an example. It was a tumultuous period for stocks. The new year began ominously, as a global economic slowdown and the December decision by the FOMC to raise rates conspired to produce stocks’ worst two-week opening on record. The S&P 500 tumbled about 9% early in the year and remained depressed through the middle of February. Just as quickly, their gloom lifted and the S&P 500 Index rebounded to actually finished the quarter with a +1.4% gain? Has the negative tide turned for good or are there still risks that could derail the market's move higher?

Read moreThe Financial Planning Association of New Jersey (FPANJ) reports that they continue to hear of people who receive phone calls or voicemails from "the IRS" demanding payment or requesting a debit/credit card number or even threatening to bring in local police. The scammers tend to target older individuals. The FPANJ wants to remind you that the IRS will never contact you by phone and will never demand immediate payment. The IRS issued a consumer alert in 2014 pointing out five easy ways to spot a suspicious call that still applies today. Click "Read More" for the link to the alert.

Read moreYou should be gearing up now to prepare your federal and state income tax returns for last year. Whether you are tackling the task yourself or hiring a professional to help, you may be wondering how long do you really need to keep tax records and supporting documentation. See the following link for suggestions from William Somers CPA.

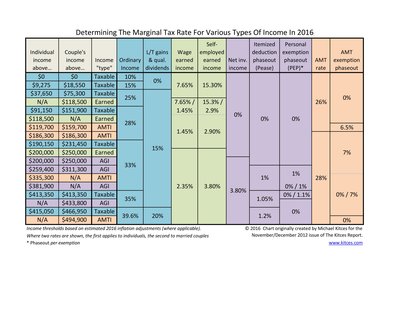

Read moreThis super handy tax chart details some of the various factors that can impact a taxpayer’s marginal tax rate, including both ordinary income tax brackets and the Alternative Minimum Tax (AMT), the tax treatment of long-term capital gains and qualified dividends, the payroll taxes that apply to earned income for wage employees and the self-employed, the new 0.9% (on earned income) and 3.8% (on net investment income) Medicare surtaxes, and the impact of various phaseouts

Read moreIf you have kids applying for college or already in college, you should be familiar with the Free Application for Federal Student Aid (FAFSA) form. The FAFSA must be submitted every year you want to apply for federal and state financial aid. Many colleges and universities, especially public institutions, also require the FAFSA. Even students who may not be eligible for need-based aid will likely be eligible for some form of financial aid, such as the unsubsidized federal student loan, known as a Stafford Loan, so filling out this form is really a necessity. The US Department of Education put together a nice piece highlighting 11 common FAFSA mistakes.

Read morePeople are only now started to talk about it, but we have been under attack for months! Some other energy-rich countries (led by our friend, Saudi Arabia) are trying to destroy US energy independence by flooding the market will oil. The strategy against us is working!

Read moreQ. My parents are divorced and my mother is ill. I don’t talk to my dad, and my mom has never been great with money. I don’t think they’ve updated their estate documents, and I don’t want to stress out my mom. Is there a way to find out without asking either of them? — Troubled

Read moreFor clients with LTC insurance, please make sure you (or your accountant) include the premium with other unreimbursed medical expenses to determine how much you can deduct. LTC insurance is expensive (especially newer policies) and having the ability to deduct some or all of the premium is important to bring the cost down. See the following link for details.

Read moreQ. My grandmother died without a will. She had two children and seven grandchildren. One of her children — my mother — is deceased. How would her assets be split? — Wondering

Read moreYou probably won't just find $1 million lying around, but I have some investment ideas if you do! More likely, you'll find just a few extra dollars like I did yesterday. There was a $25 check from my insurance company in the mail - a refund of an overpayment from almost 2 years ago. Even this small amount made me smile since it covered my share of yesterday's lunch with 4 friends! Click on the following link to read a nice short article on a few areas where you may also find some missing or forgotten money.

Read moreIf millennials and their Generation X counterparts don’t have enough investable assets, why would they hire a financial advisor. That's typical thinking in the investment management and financial planning industry. In fact, this was basically the statement made by another advisor when interviewed by Financial Advisor magazine. Is it true? Alan Moore and Michael Kitces, launched the XY Planning Network in 2014 to battle against this thinking. Click on the following link to read their take on this issue. I particularly liked reading about their personal histories.

Read moreI am one of the original 30 members of the XY Planning Network. We had a feeling the concept was good, but had no idea how successful XYPN would become! At our first ever annual conference, which was the most fun I've ever had this type of event, it was announced the group had quadrupled in size! Every advisor I met at the conference was super excited to be offering fee-only financial planning services and to be accepting younger clients, which is contagious (in a good way!). I had the privilege of being spotlighted by XYPN a few months ago and here is the link.

Read moreHere are some great tips on how Millennials can find an advisor. But WAIT... these tips are really good for everyone looking for an advisor! Maybe Millennials aren't that different when it comes to their money - they still want to maximize their money and hire someone qualified to help them. Some advisors are pompous jerks or talk to you like a child. Others are just robots (literally!). Give me a call if you want to "connect" with an advisor that can help with all of your financial planning concerns.

Read moreAS YOU PREPARE to send your college students back to school, buying stuff for their dorm room is probably high on your list. But you might be forgetting about an important protection: making sure your kids' belongings are covered by your homeowners insurance policy. (Inside Jersey)

Read moreEveryone knows the standard summer safety tips: Only swim where there’s a lifeguard, apply sunscreen liberally, drink plenty of liquids. But there’s one item your financial advisor would probably like to add to that list: Beware of the sudden, seemingly unstoppable urge to buy a second home in the place where you just spent two idyllic weeks of vacation. As one financial website puts it: The summer is “a time to relax, kick back and make dumb financial decisions.” Buying that home may not be such a dumb decision after all, but it needs to be one that’s made with your head and not your heart – and only after consulting financial, legal and real estate experts. (Investopedia)

Read moreThe SEC’s Office of Investor Education and Advocacy issued an Investor Alert Wednesday warning investors not to “trust someone with your investment money just because he or she claims to have impressive credentials or experience, or manages to create a ‘buzz of success.’” (ThinkAdvisor)

Read moreGetting cash out of your home through a reverse mortgage is costly, even with the Federal Housing Administration's new reduced-fee Home Equity Conversion Mortgage, or HECM, Saver plan. For some retirees, the solution is turning to a family member instead of a financial institution. (Bankrate)

Read moreEven if you don’t have many assets, you might think you don’t need a will or other end-of-life documents. But such documents can make taking care of you in your final days easier, along with making the lives of the loved ones you leave behind less stressful and problematic. Here are four end-of-life documents worth having, and worth letting your family know about long before you reach old age. (Termlifeinsurance.com)

Read moreWhen you leave a job, you pack up your stuff on your way out, but what about your 401k plan? Many people just leave it where it is and then forget about it. Is this best choice? Here's a good unbiased overview of your options from the National Association of Retirement Plan Participants. Teaser - I generally recommend rolling all former employer's 401k plans into a single IRA. Not only does this keep the number of accounts to a minimum, but it gives you virtually unlimited investment choices without trading restrictions. Importantly, after rolling over your 401k to an IRA, you can consider having your portfolio professionally managed by a privately owned registered Investment Advisory firm (such as The Investment Connection), legally obligated to accept fiduciary duty and place your interests before shareholders or any other party – without conflicts.

Read more